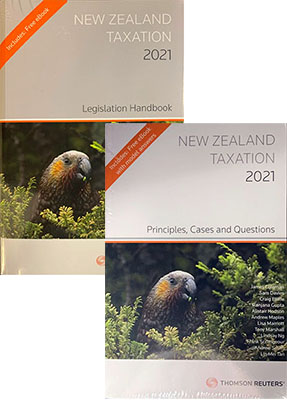

New Zealand Taxation 2021: Principles, Cases and Questions + Legislation Handbook (Bundle)

Click to view other formats:

9771177025424 NZ Paperback

9771177025370 NZ Paperback

- Blurb -

New Zealand Taxation Principles, Cases and Questions 2021 provides a topical analysis of all the major areas of taxation as they are applied in New Zealand. Its practical, uncomplicated approach makes this resource the ideal first point of reference for students and others seeking to understand the principles of laws of taxation. New Zealand Taxation Legislation Handbook 2021 is the essential legislative resource for accounting and law students, and the companion text to New Zealand Taxation Principles, Cases and Questions 2021. Cross-references between these two texts are provided for all relevant provisions.- Full Details -

| Status: | Temporarily Out of Stock - Available to backorder |

| ISBN-13: | 9771177025455 |

| Published: | 14 Dec 2020 |

| Published In: | New Zealand |

| Imprint: | Thomson Reuters |

| Publisher: | Thomson Reuters |

| Format: | Paperback |

| Pages: |

- Delivery ETA -

In stock - for items in stock we aim to dispatch the next business day. For delivery in NZ allow 2-5 business days, with rural taking a wee bit longer.

Locally sourced in NZ - stock comes from a NZ supplier with an approximate delivery of 7-15 business days.

International Imports - stock is imported into NZ, depending on air or sea shipping option from the international supplier stock can take 10-30 working days to arrive into NZ.

Pre-order Titles - delivery will vary depending on where the title is published, if local stock is available in NZ then 5-7 business days, for international imports it can be 10-30 business days. In all cases we will access the quickest supply option.

Delivery Packaging - we ship all items in cardboard sleeves or by box with either packing paper or corn starch chips. (We avoid using plastics bubble bags)

Tracking - Orders are delivered by track and trace courier and are fully insured, tracking information will be sent by email once dispatched.

- Notify Me When Back In Stock -

Notify me by email when this product is back in stock.

Details of the product above will be automatically included with your enquiry.

|

© Copyright 2024 AllTextBooks.NZ |